Why Do Pharmaceutical Companies Use Polyethylene Glycol in Capsule Production?

The pharmaceutical industry is witnessing a monumental growth in emerging economies, such as India, Brazil, and China, owing to which the consumption of polyethylene glycol (PEG) is increasing exponentially, as it is used as an inactive ingredient in the pharmaceutical sector. PEG is used as a surfactant, solvent, and suppository base for capsules and tablets. Additionally, the rapid technological advancements in the pharmaceutical sector will also facilitate the consumption of PEG in the forthcoming years.

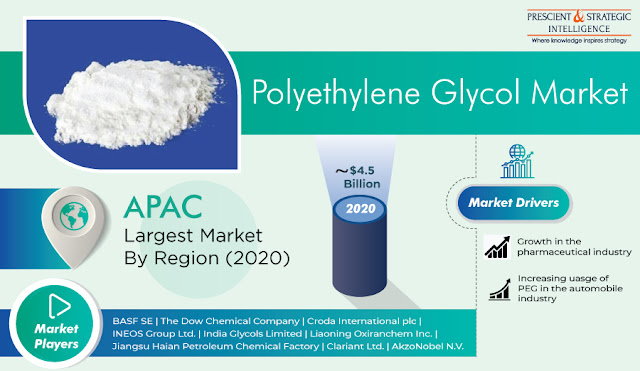

Moreover, the escalating healthcare expenditure, on account of the surging cases of skeletal problems, obesity, hypertension, and cardiovascular diseases (CVDs), will also catalyze the polyethylene glycol market growth during the forecast period (2021–2030). According to P&S Intelligence, the market generated ~$4.5 billion revenue in 2020. The market growth can also be owed to the burgeoning demand for personal care products, as PEG is used as a specialty solvent and surface-active agent in creams and lotions, bath oils, toothpaste, deodorants, detergents, soaps, conditioners, shampoos, and lipsticks.

The application segment of the polyethylene glycol market is classified into industrial, medical, personal care, construction and infrastructure, and others, such as plastic, aerospace, and automotive. Under this segment, the medical category generated the highest revenue in 2020, due to the widening application base of PEG in the medical industry, owing to the soaring healthcare expenditure worldwide. For instance, the World Bank estimates that the global per capita healthcare expenditure increased from $1,405.843 in 2017 to $1,459.319 in 2018.

In recent years, PEG producers have been engaging in facility expansions to cater to the needs of their existing and potential client base. For instance, in September 2019, BASF SE expanded its Verbund plant in Belgium to increase the manufacturing capacity of ethylene oxide and its derivatives to around 400,000 metric tons per year. Other companies focusing on facility expansion include India Glycols Limited, Huntsman Corporation, Croda International plc, Jiangsu Haian Petroleum Chemical Factory, BASF SE, Liaoning Oxiranchem Inc., The Dow Chemical Company, Clariant Ltd., INEOS Group Ltd., and AkzoNobel N.V.

Globally, the Asia-Pacific (APAC) region accounted for the largest share in the polyethylene glycol market during the historical period, and it is expected to retain its dominance during the forecast period as well. This can be owed to the expanding medical and pharmaceutical, building and construction, and automotive industries in the region. The increasing consumption of water-based paints, inks, and coatings in the construction sector is driving the PEG demand in the region.

Thus, the flourishing pharmaceutical sector and growing healthcare expenditure will create an enormous requirement for PEG.

Comments