Groundwater Depletion Supporting Expansion of Domestic Pump Market

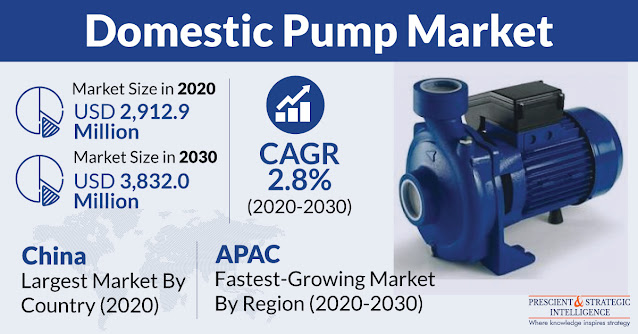

The global domestic pump market revenue stood at $2,912.9 million in 2020, and it is predicted to rise to $3,832.0 million by 2030. According to the estimates of the market research company, P&S Intelligence, the market will grow at a CAGR of 2.8% from 2021 to 2030. The surging construction activities in the residential sector, increasing number of high-rise buildings, where pumps are required for maintaining the water pressure till the upper storeys, depletion of groundwater, and rapid urbanization are the major factors fueling the growth of the market.

As per the Our World in Data, the global population will surge to 8.2 billion and 8.6 billion by 2025 and 2030, respectively. The surge in the worldwide population would create burden on the existing water infrastructure, which supplies drinking and utility water. In addition, a large number of people are rapidly shifting from rural areas to cities and towns every year. As per the World Bank, the share of the urban population in the global population surged from 55.2% to 56.1% from 2018 to 2020.

Owing to the rising urbanization rate, many governments across the world are focusing on improving the infrastructure, which would subsequently fuel the demand for domestic pumps, thereby causing the expansion of the domestic pump market. The rapid depletion of the groundwater level is another major domestic pump market growth driver. As per the Population Action International, nearly 2.8 billion people in as many as 48 countries are predicted to experience water scarcity by 2025.

This category is predicted to demonstrate the highest growth rate in the market in the coming years. This is ascribed to the large-scale usage, inexpensive nature, and excellent pumping efficiency of these pumps. Globally, the Asia-Pacific region dominated the market in the past. This was because of the presence of a large population and surging number of ongoing housing projects for accommodating the soaring population in the region. Furthermore, the abundant availability of power for operating these pumps is also driving the growth of the domestic pump market in the region.

Hence, it can be said without any hesitation that the sales of domestic pumps will surge sharply in the coming years, mainly because of the rising requirement for potable and drinking water, on account of the soaring urban population and increasing construction and infrastructure development projects in several countries.

Read More: https://www.psmarketresearch.com/market-analysis/domestic-pump-market